Related Categories

Related Articles

Articles

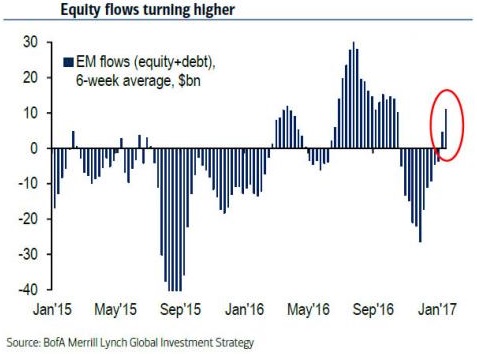

EM Fund Inflows

(Status: 9th Feb. 2017)

According to the latest fund flow report from BofA's Michael Hartnett, "it's risk-on in Bonds, it's inflation-on in Stocks, and EM is now playing role of cyclical catch-up trade." First in bonds, there has been renewed interest in EM debt...

...(inflows 5 of past 6 weeks), and 9th consecutive week of inflows to TIPS ($1bn…biggest week for TIPS since Trump election). Then, in stocks there has been inflows to equity funds investing in value, Europe, Japan (like TIPS, largest week of inflows for Japan since election), materials, and financials.

Paradoxically, Emerging Markets have also gained as a Trump's "economic nationalism" had, at least until yesterday (Thursday, 9th Feb. 2017), proven to be dollar-negative not dollar-positive.

Reminder for anniversary: 10th Feb 2017 marks the one-year anniversary of lows in oil USD 26/bbl, S&P 500 @ 1,810 points and highs in VIX 30.

VIX: Volatility Index

BoFa: Bank of America Merrill Lynch

TIPS: Treasury Inflation Protection Securities

EM: Emerging Markets

zerohedge-link: www.zerohedge.com/news/2017-02-10