Related Categories

Related Articles

Articles

US-election years (Pre-months)

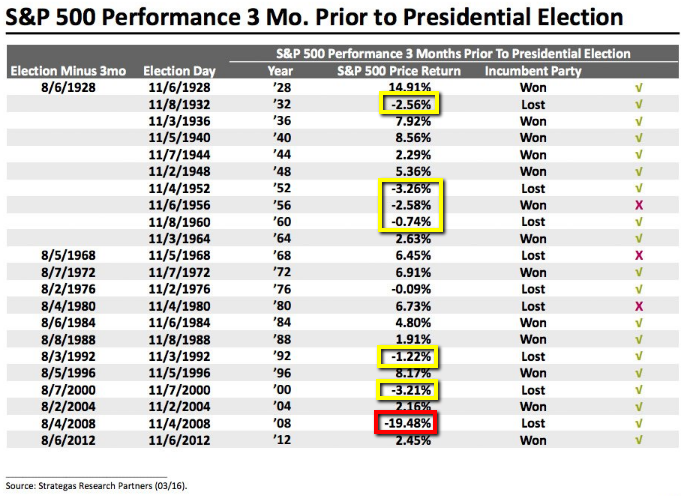

If you want to get a feel for how the US presidential election will play out, then Byron Wien, Blackstone's vice chairman, has a suggestion: Look at stocks. Reminder: On the 8th Aug. 2016 the S&P 500 stood @ ca. 2,180 points.

Since the 1920s, the incumbent party usually wins when market returns are high. But Wien cautioned that it doesn't work out perfectly, as shown in the blips in 1956, 1968, and 1980.

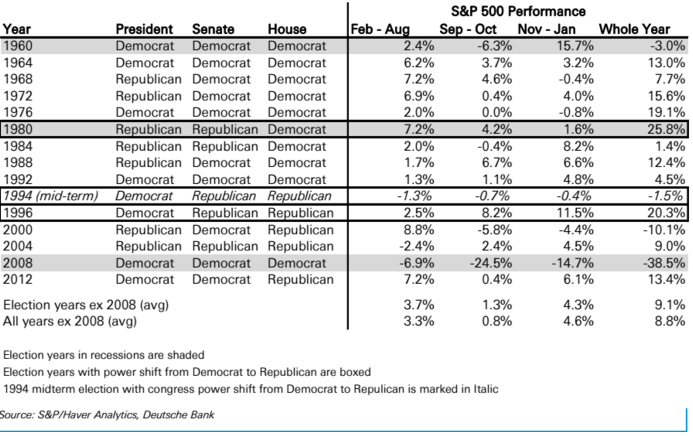

When the country prospers during an election year, then it is likely to favor the incumbent candidate, as voters feel good about current and future prospects. When the economy is in a bad shape, then voters are likely to seek change and punish the incumbent or their political party.

Wien's prediction method echoes that of Daniel Clifton at Strategas Research Partners, who saw that the S&P 500 has correctly "predicted" the winner in 19 of the past 22 presidential elections.

Of course, this doesn't mean that strong markets direct the outcome of elections. Instead, it may be that past market gains have reflected the overall economic trend, which in turn influenced voters' decisions. There's many reasons to wonder if that's true this time around - with stock gains driven by many factors, like low interest rates - that actually indicate economic weakness.