Related Categories

Related Articles

Articles

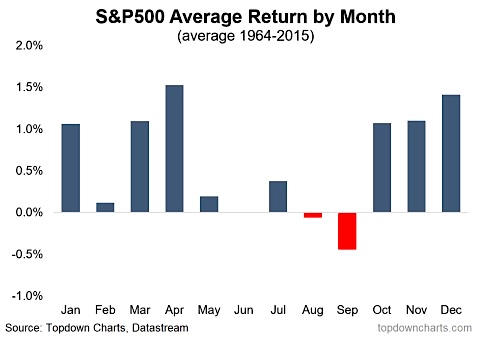

September (aaah)

For investors who are fearful of using market timing but still wish to maximize returns, the idea of sitting out September each year might sound like a strange idea to you, but might be a pretty good trade-off between simplicity and profit maximization. The two...

...ingredients that are required of investors are (A) a long-term perspective and (B) the willingness to act on 31st August and 30th September of every year, regardless of the headlines of the day and the present outlook for the market...

or maybe to just take off some salt from the plate (selling some stocks or part of ones holdings). One of the most consistent longer-term trends in the stock market over the past century has been the tendency of the stock market to perform poorly during September. So being prepared for some "action" is never a bad idea anyway (independent of the month of the year) - personally I will try to avoid any purchases within the next weeks.

Given that trend, we can now unveil "one of the better market-beating strategies in the world." Market timing can become involved, with many investors tracking lots of different indicators hoping to divine the precise moment when bull changes to bear and vice versa. But as most experienced investors know, one of the real keys to beating the market is to adopt a long-term time frame and to follow year in and year out a strategy with a solid long-term performance record. So, rather than build in dozens of indicators and oscillators and trend lines and overbought-oversold indicators, what if all we did was take a more risk-averse stand to the stock-market during September every year?