Related Categories

Related Articles

Articles

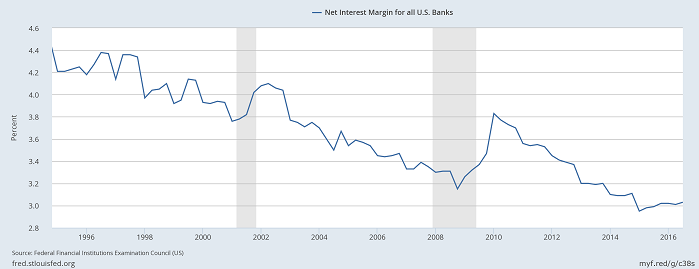

Banking in the US / Net Interest Margin & 10YR-US-Treasuries

Net interest margin is a measure of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders (for example, deposits), relative...

.gif)

...to the amount of their (interest-earning) assets. It is similar to the gross margin (or gross profit margin) of non-financial companies. It is usually expressed as a percentage of what the financial institution earns on loans in a time period and other assets minus the interest paid on borrowed funds divided by the average amount of the assets on which it earned income in that time period (the average earning assets).

Net interest margin is similar in concept to net interest spread, but the net interest spread is the nominal average difference between the borrowing and the lending rates, without compensating for the fact that the earning assets and the borrowed funds may be different instruments and differ in volume. The net interest margin can therefore be higher (or occasionally lower) than the net interest spread.

Since Feb. 2016 the Banking Index seems to anticipate the possible, sustainable Interest-Rate-Hiking environment. Generally speaking Banks should profit from rising interest rates. Rising interest rates normally signal more prosperous times and of course help to raise the banks' Net Interest Margins:

Explanations for the "NIM" taken from wikipedia: https://en.wikipedia.org/wiki