Related Categories

Related Articles

Articles

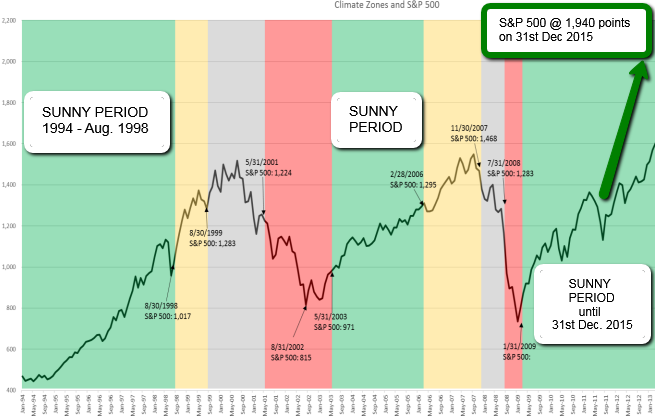

Sungarden Investment Climate Indicator (S&P 500)

1994-Aug. 2016

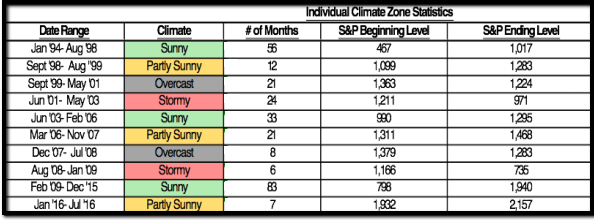

Sungarden Investment Research created the Investment Climate Indicator ("ICI") back in 2014. The ICI is a back-tested mix of several investment and economic indicators they have followed since the early 1990s. Since that time...

..., Sungarden has published the indicator's current score as part of the firm's monthly Investment Climate Report, which expresses their opinions about the reward/risk tradeoff facing investors in the current investment market environment.

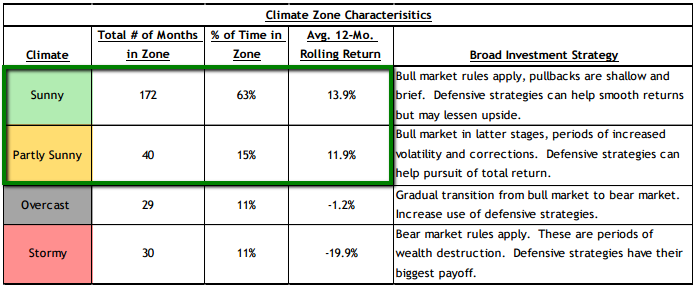

Sungarden assigned weightings to each indicator and stress-tested it, with the goal of converting over 20 years of data into a monthly indexed figure that, when viewed in the context of that longer term period, can act as a sort of long-term "GPS" for setting investment strategy.

Importantly, the ICI is NOT a market-timing system. It is but one factor in a complex process of making investment decisions. In fact Sungarden has determined that the actual level of the ICI is less important than its 6-month moving average. Thus, it moves slowly, and so when it moves from one climate type to another, that does not mean that the market environment will change on a dime. Sungarden has concluded that the ICI is a goodbottom-line aid, but must be viewed in context with its own history.

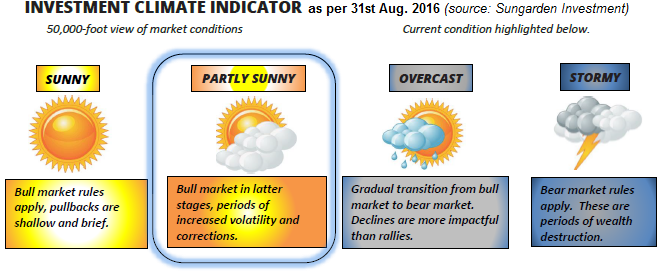

Currently the system (the markets may be) is in Partly Sunny-mode. During the Partly Sunny phase, Sungarden judges the stock market to still be a "bull." However, there is something different from the prior Sunny phase. Drops of 10% of more begin to occur, and then do so with more frequency. These corrections will at times strike the market as a whole, but it is likely they will take the form of "rolling" corrections through one or more industry groups at a time, such that the broad market is relatively unscathed.

Thanks to a psychological belief by some investors that "buy the dips" is always an effective strategy, bull markets die hard. Extremely loose central bank policy is also a big factor in extending bull markets beyond the Sunny period into the phase rated by Sungardens' ICI system as PartlySunny.

Where do you go from here? That is up to you! The Sungarden Investment Climate Indicator can be an important factor in intermediate to long term decision-making, but it is not to be used in isolation.

Direct links:

http://www.sungardeninvestment.com/investment-climate-report

www.sungardeninvestment.com/whitepapers

Whitepaper Sep. 2016 (.pdf)