Related Categories

Related Articles

Articles

S&P 500 ETFs (tiny insight)

Are you wondering if the S&P 500 is a good place to park your investment dollars? Well, Investopedia picked 3 ETFs to explain how to track the S&P 500...The S&P 500 is perhaps the best depiction of the U.S. economy, covering all the main sectors...

...and representing roughly 80% of the nation's (U.S.A.) market cap. It's not surprising that some USD 7.8 trillion of investor cash is tied to the equities that make up the index - over USD 2 trillion of which is in index ETFs.

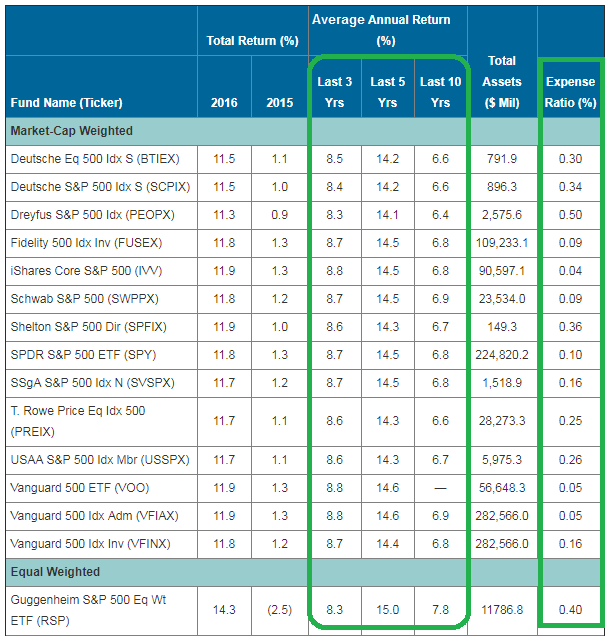

Of course, not all S&P 500 ETFs are created equal. Some do a much better job of replicating the benchmark, and others do so at enviably low costs compared with their competitors. You've found your investment sweet spot when you discover a fund that manages to perform well at an attractive cost.

SPDR S&P 500 ETF (SPY)

Issuer: State Street Global Advisors

Expense Ratio: 0.09%

While technically not an ETF (SPY is a unit investment trust, which are typically more tax-efficient vehicles than managed funds - typically for US-Investors), this is the oldest of the S&P 500 benchmarked funds and by far the largest in terms of Assets Under Management. It is also extraordinarily cheap to hold, with an expense ratio of just 9 basis points, and it very closely tracks the performance of the benchmark index.

The fund is also extremely liquid, with a trading volume in excess of USD 14 billion per day, which makes it attractive as a tactical trading instrument as well as a buy-and-hold investment.

iShares Core S&P 500 ETF (IVV)

Issuer: BlackRock

Expense Ratio: 0.04%

If you're looking for straight-up S&P 500 exposure at rock-bottom prices, IVV might sound interesting. It's difficult to find a fund that delivers tight benchmark performance with such low holding costs. Of course, it can't come close to SPY in terms of volume, but IVV is plenty liquid for just about every class of investor, with over 3 million shares changing hands every day. It is also a true ETF, which means it avoids the cash drag inherent in a unit investment trust like SPY.

Vanguard S&P 500 ETF (VOO)

Issuer: Vanguard

Expense Ratio: 0.04%

With an inception date of September 2010, VOO is the newest of these three ETFs, but it's a part of Vanguard's pretty well respected portfolio of funds. You might be tempted to wonder if there's really much difference between VOO and its primary peers IVV and SPY, and in all honesty, there's not a lot. Like its peers, VOO has low costs and high liquidity, and it offers the large-cap coverage you expect in an S&P 500 benchmark fund.

While the differences may be minor, they are potentially important. VOO only discloses its holdings on a monthly basis - not

daily like IVV - which is a slight ding in terms of transparency. And VOO, unlike SPY, reinvests its interim cash.

link / If you want to read more on this: Top 3 ETFs to Track the S&P 500 for 2017 | Investopedia

www.investopedia.com/investing