Related Categories

Related Articles

Articles

Ever thought about farming some yield from your Crypto-Hodlings?

Well, that might be a risky task.

But one, which I am happy to experiment around with.

I participated in the Bull run of Binance-coins (BNB) from the year 2018 onwards until now. I held some BNB-coins, when they were...

...below 20 US-Dollar per coin and I also held some, when they were reaching All-Time-Highs at ca. 360 US-Dollar. With such a decent (unrealized) gain-cushion in mind I found myself in the position of an Early-Adopter in the Space of DeFi. But to be more precise: In the adoption phase of Year 1 of that new Era of Decentralized Finance (DeFi).

To give you some practical ideas and top some some recent data from PancakeSwap (CAKE) and AutoFarm (AUTO) onto the Archive-timeline, I will write down this posting here.

As per 1st March 2021 (Monday) the Crypto-Markets are building some strength again, after the Crypto-Markets and its famous DeFi coins like CAKE, UniSwap and Sushi tanked over the last weekend.

I want to guide you through my thoughts about farming in following sections:

1) PancakeSwap versus (?) UniSwap / Market Cap

2) My personal lower limit of 8 USD per CAKE for calculating potential Yields

3) AutoFarm-ing with AutoFarm (turbo-compounding to the limit - more risk included)

1) PancakeSwap versus (?) UniSwap / Market Cap

In the last days I rechecked the Market Cap of "CAKE" and found at that my belief was that that coin should have a potential support-zone at the 8 USD-level, which more or less would put that Market Cap at ca. 1 billions USD. For the success, PancakeSwap experienced the last weeks and months, that valuation might be justified versus more established Decentralized Exchanges (DEX), like UniSwap.

As one can see in the follwing chart, CAKE nearly hit my magic price of 8 USD, but made its turnaround above that level, to levels far above the psychological price-level of 10 USD.

Just to have some understanding: UniSwap is currently carrying a Market Cap of ca. 7.4 Billion USD, while its coin price is sitting at 23.8 USD.

My own opinion, which is NOT FINANCIAL ADVICE, would put PancakeSwap at a valuation around 2 bn, versus only 1 billion. Currently the price of CAKE is around 12.22, which would be far below my own short-term to medium-term fair value for CAKE at a level of ca. 16.3 USD ( = Market Cap of ca. 2 billion USD.)

2) My own lower limit of 8 USD per CAKE for calculating potential Yields

I use my personal lower limit of 8 USD per CAKE for calculating potential Yields (returns) on my CAKE-Farming-Strategies. Having made my comment about the personal minimum calculation-price for my yield-strategies I want to look up some potential Liquidity Pools for my Farming (let's call it HUNTING for yield):

Since I am a believer in the Bitcoin-Idea, but NOT a Bitcoin-Maximalist, I would like to take a closer look at the LP-Pair:

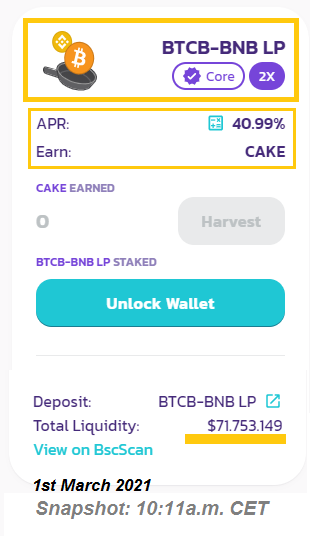

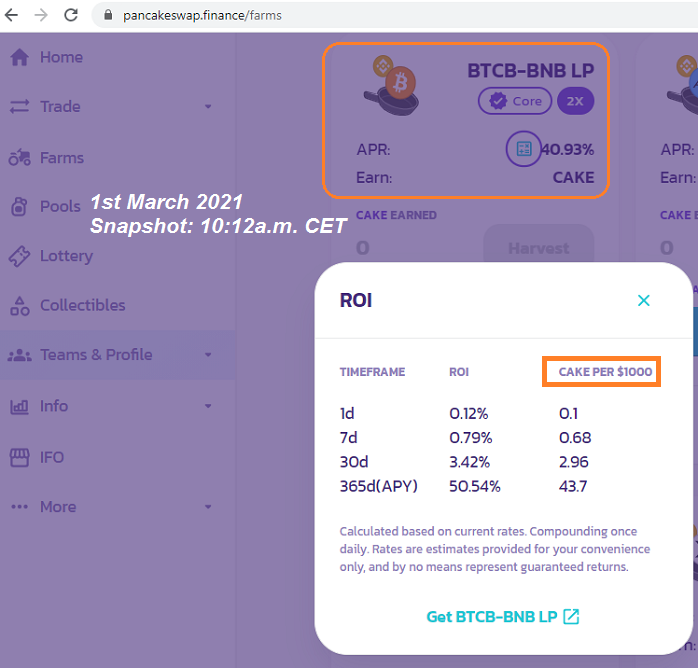

BTCB - BNB (Bitcoin & Binance-coin)

If one takes a look at the CAKE-Farm, one will find, that one gets a "potential" Annual Percentage Return (APR) of ca. 40.9 %. This Return will be delivered via delicious CAKEs (you can't eat them...).

As mentioned above I will calculate my potential USD-earnings via the 8 USD-mark. Important to mention, that I am also happy, that the TOTAL LIQUIDITY in this pair is around 70 million USD. So that is not a tiny little jar of marmelade.

Now let's take an even closer look at my selected pair BTCB-BNB LP: on the right side of the box it is stated that up to 43 CAKEs can be earned within the upcoming 12 months. For my own calculations I would claculate a conservative earnings-sum of 30 CAKEs x 18 USD = 240 US-Dollar (Taking the stated Cake# of 43 and multiplying with a current CAKE-price of ca. 12 would lead to higher outcome: 43 x 12 = 516 USD versus 1,000 USD-Liquidity Pool. A nice potential! return)

3) AutoFarm-ing with AutoFarm (turbo-compounding to the limit - more risk included)

AutoFarm is a yield optimizer on the Binance Smart Chain and Huobi ECO chain with currently more than 1.3 billion total value locked (TVL) into its farming pools.

The main differentiator for AutoFarm compared to other farming projects like for instance Beefy is that they have one of the lowest fees in the market. They have two main products of which one is relevant for my farming-strategies: Vaults, which auto-compounds ones yields at empirical optimal intervals, while pooling gas costs through battle-tested smart contract code and best in class yield optimising strategies. Autofarm claims that it uses a proprietary dynamic harvesting optimizer to enable the highest APYs on their vaults.

Risks with AutoFarm

RISK, risk: Aside from smart contract risks from the underlying farms (e.g. Venus and Pancakeswap), one is now compounded with AutoFarm’s smart contract risk, which is semi-mitigated with a 24-hour timelock. Its contracts are also audited by Vidar, a community auditor (not a professional one). However, since most of their vaults are created using the same construct, it reduces the need for constantly auditing each vault.

AutoFarm tokenomics/

Interesting to know how AUTO is produced

----------------------------------------------------

AutoFarm has its own proprietary token, AUTO, with no pre-farm nor pre-sale. It’s minted linearly from 15th December 2020 and will end approximately during October 2021. AUTO is produced at a rate of 0.008 $AUTO/ block and earned when users farm the tokens by participating in their vaults. Vault fees (1.5–3.0%) on vault users’ profits are used to perform market buy-backs and these $AUTO are burnt out of supply forever as well.

How to participate: One can participate in AUTO farming by obtaining the required tokens for the vault. For example, there are single asset vaults like WBNB (wrapped Binance-Token) and BUSD (USD-Stablecoin)which just require the underlying token to be deposited.

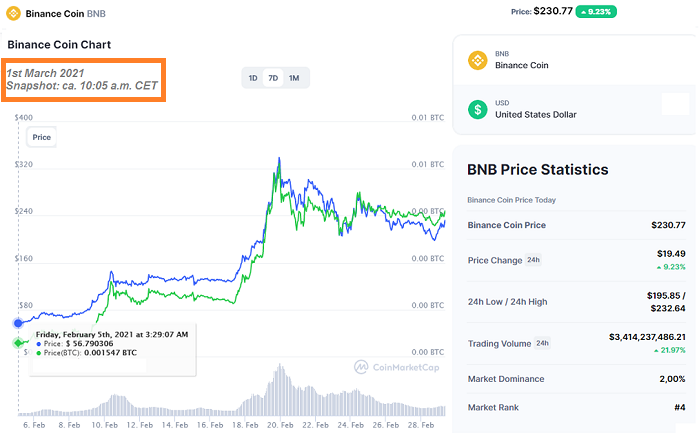

In the examples stated above I took the pair WBNB-BTCB since both coins experience a similar path (strong correlation), which reduced the potential "IMPERNANT LOSS"-issue for me. The more those two coins in that LP move in the same direction, the less likely an issue of IMPERNANT LOSS might arise. The following chart is showing how Bitcoin and Binance move in tandem during the last days and weeks:

These vaults farm Venus tokens and automatically sell them for more of the underlying tokens. On the other hand, there are LP vaults which require Pancakeswap's LP tokens. First one has to obtain Pancakeswap LP tokens, and then one goes on by depositing ones LP tokens here in AutoFarm.

AutoFarm's smart contracts will take care of ones farming, reward claiming and compounding your underlying. That's it! It's pretty simple to get started, and you don't need to buy AUTO to participate in this project.

link to understand "AutoFarm-ing":

https://medium.com/stakingbits/introduction-to-autofarm-on-the-binance-smart-chain-bc285203710c