Related Categories

Related Articles

Articles

Ethereum (new All-Time-High)

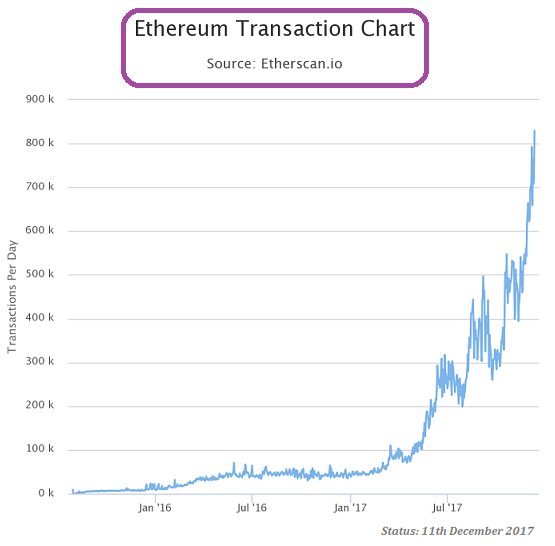

Ethereum, the 2nd most popular cryptocurrency, surged by over 30% in the last 24 hours to reach a current price of over USD 620 today (12th Dec. 2017). Today's surge might also have to do with the fact that the ethereum network recorded its highest number...

...of transactions yesterday (11th Dec. 2017). Furthermore: The record comes a day after a group of banks led by UBS announced a data quality control project on Ethereum's blockchain. As a Reminder: Ethereum's blockchain, unlike bitcoin's, can support layered on applications and facilitates so-called smart-contracts.

To date, the cryptocurrency’s price is up by a remarkable 14,500% from the start of 2017. Ethereum's market capitalisation has jumped to over USD 60 billion from USD 722 million in January 2017.

Apart from a recent "herd-behavior style hype" in the cryptocurrency-space investors seem to be enthused about the number of use cases for ethereum's smart contracts. Throughout the year, there has been growing awareness about such contracts enabling transactions involving ether.

From banks to gaming platforms, numerous established institutions are testing ethereum's smart contracts to offer or innovate services. Of course, the cryptocurrency's price benefits from ether's network effects.

As mentioned, Ether's record tear follows the announcement Monday, 11th Dec. 2017, of a data quality control project on Ethereum, the blockchain network underpinning ether, by a group of banks led by Switzerland-based money manager UBS. Again: Ethereum, unlike bitcoin, can support applications on its network for projects outside of digital money, such as so-called smart contracts.

Barclays, Credit Suisse and UBS are among the banks involved in the pilot, which will help prepare them for Markets in Financial Instruments Directive (MIFID) II, a sweeping regulatory overhaul in Europe set to go live in 2018. "It is a tool that we are using to improve the quality of our reference data that will be used for regulatory reporting for Mifid II," Peter Stephens, head of blockchain innovation at UBS, told Business Insider. Instead of trusting a third party to review data and then provide feedback about the accuracy of each party's data, the banks will rely on the blockchain. "We are putting our trust in the blockchain," Stephens said.

Disclaimer / Disclosure: Ralph Gollner hereby discloses that he is directly and indirectly investing in Ethereum and Bitcoin. Both are subject of the commentary, Snapshot above (as per 12th Dec. 2017).

Attention: HIGHest RISK !!

links: