Related Categories

Related Articles

Articles

EmergingMarkets-Debt-Index

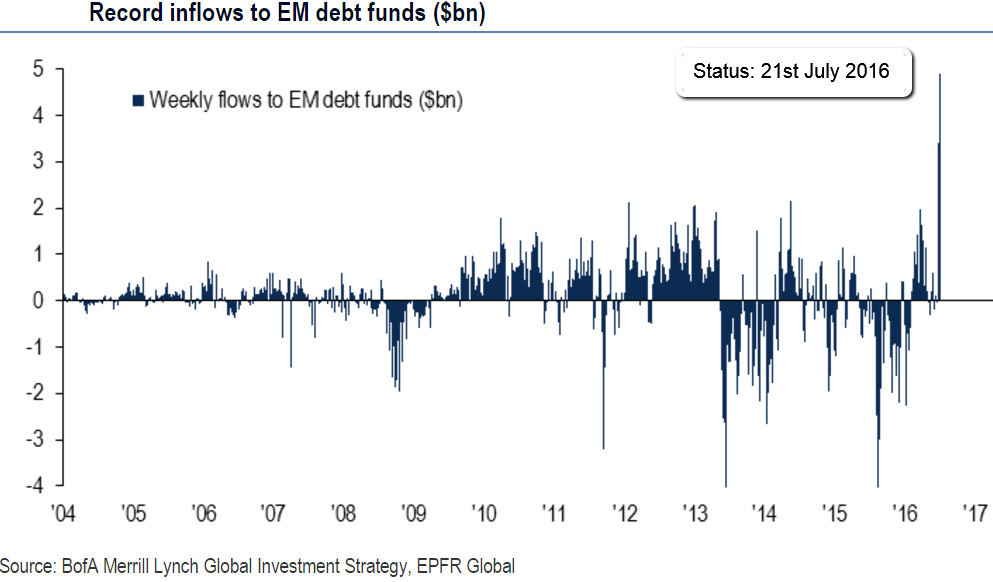

Investor appetite for emerging-market bonds has pushed buying in debt-oriented funds tied to those regions to records. Net inflows to funds that buy EM-bonds reached an all-time high in the week through 20th July.

Roughly USD 14 billion has poured into emerging-market debt over the past four weeks, marking the longest streak of buying in emerging-market debt funds since September 2014, according to a weekly report on funds flows from Bank of America Merrill Lynch.

Demand for emerging-market debt has been fueled, in part, by a global environment where more than USD 12 trillion in government debt is offering negative interest rates, according to Fitch Ratings. Essentially, negative yields mean that lenders pay borrowers to park their money. Indeed, the German 10-year benchmark bond known as the bund, offered a yield of negative 0.12% as of July-End 2016.

Against that backdrop, relatively riskier debt in less-developed economies have offered comparatively richer yields, luring investors hunting for better returns on their investments. For example, China’s 10-year government bonds were yielding 2.81% compared with a yield of 1.45% for the U.S. 10-year Treasury note.

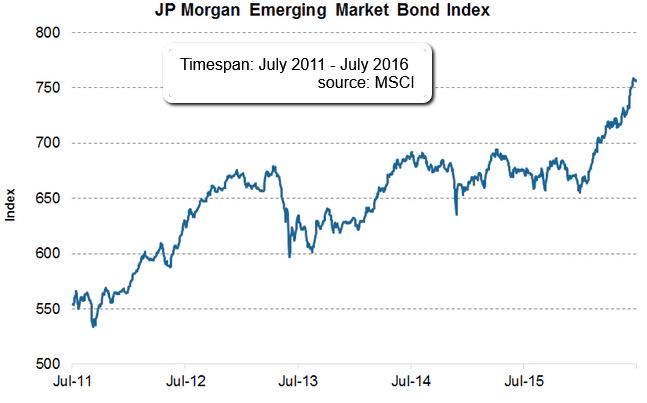

The demand for EM debt rose especially in June (2016) after fears of an interest rate hike largely subsided. The JPMorgan Emerging Market Bond Total Return Index, which was down 0.3% in May, rebounded 5.5% since June. Year-to-date, the index is up 12.8% while its local-currency peer, GBI-EM, is up around 14%. (see also chart above)

The higher demand for emerging market government bonds has pushed prices higher while pulling down the yield on J.P. Morgan’s dollar-denominated index to a six-month low of 5.89%.

Over the past decade, emerging markets bond markets have increasingly drawn the focus of global investors as a higher-yield alternative to developed markets bonds. Emerging markets debt now plays a role even in the portfolios of many conservative investors. Initially, investors insisted on the hard currency emerging markets bonds, but increasingly local currency bonds are being included in portfolios.

In recent years, not only investors, but markets themselves have further evolved. The emerging markets bond markets have grown steadily, and the investment universe has become broader. More and more countries, currencies, and issuers have been added, liquidity has grown, investors’ diversification opportunities have been expanded, and the quality of the issuers has improved. The emerging markets bond market has become a completely standard/strategic asset class for many investors.

links:

www.bloomberg.com/news/articles/2016-07-22/emerging-market-inflows-keep-setting-fresh-records

http://marketrealist.com/2016/07/time-look-emerging-market-debt

elder .pdf/research on Emerging-Markets-Debt Indices http://www.lazardnet.com