Related Categories

Related Articles

Articles

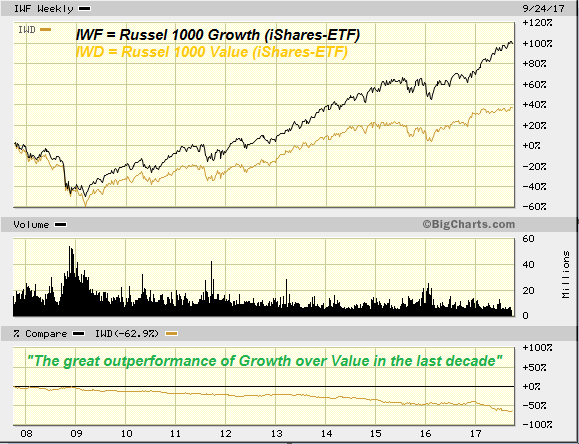

Value Investing Having Its Worst Run Since The Financial Crisis

Status: Aug/Sep. 2017

Over the past decade, the performance of U.S. growth stocks has been almost three times better (!) than that of value stocks. Index fund giant State Street Global Advisors calls it "the longest...

... period of underperformance for value since the late 1940s." This trend is not new for value investors. We have seen this play out time and time again. If you go back to the great depression or back to the tech bubble and the late nineties and early two thousands. You go back ten years ago to the global financial crisis - and before these periods happened.

You saw growth outperform so much to the point that people would say "oh value investing is dead it can't come back it's impossible - and sure enough after you had those big market downturns >>> value is what tends to outperform when you have huge pullbacks or huge bear markets. And even after those bear markets you tend to see value again continue to do well.

Value from the year 2002 all the way to 2007 >>> Value did really well in that period! Reminder/State Street: "[Now we have/had the] Worst period for Value-Investing since the late 40s (!)"Reminder on Historical periods:

For example, Bank of America did a recent study and found that since 1926, growth stocks (companies with faster appreciation in earnings per share) returned an average of 12.8% annually. But value stocks (companies that are inexpensive relative to sales, net income and book value) generated an average return of 17% over the same period.

Compounding at these rates, USD 10,000 invested in growth stocks would be worth USD 194,294 in 25 years. The same amount invested in value stocks would turn into USD 506,578.

>>> The difference is not insignificant. Value beats the heck out of growth over the long term.

Under following URL you can find the audio-link for interview on "Growth over Value" (WSJ):

https://acquirersmultiple.com/2017/08/value-investing

Weekly updated chart

comparing the Growth-Sector versus the Value-Sector (in form of Russel 1000 stocks)