Related Categories

Related Articles

Articles

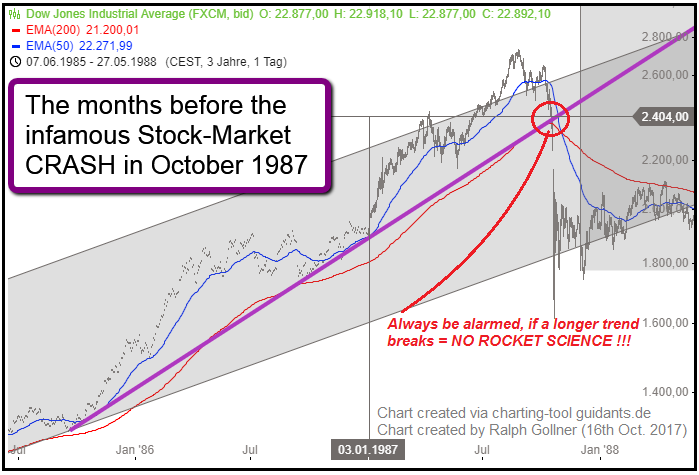

30 years after historic stock market crash

(Oct. 1987)

This week will mark the 30th anniversary of the market crash of 1987, better known as Black Monday. On 19th Oct. of that year, financial markets around the world plunged into chaos. The Dow Jones industrial average plummeted 22.6 %,...

...by far the largest single-day decline in its history. Based on current values, that's equivalent to losing just more than 5,000 Dow points in a single day.

(But) Black Monday still offers lessons.

Most people remember the fall in stock prices that day, but somewhat forgotten is the market's 37 percent rally in the first nine months of 1987. But, GREED is always "hiding" somewhere...

Furthermore the Dow Jones Industrial Average was doubling in value in a relatively short period starting from Sep. 1985 until Aug./Sep. 1987. 100% Plus in only 24 months is really not a bad return for a broad stock-market Index (from 1,300 points in Aug. 1985 up to > 2,600 points by Aug. 1987). Reminder: A return of ca. 7% - 8% per year might be the more appropriate average return to expect (normally)...

Strong market performance is worth celebrating, but too often it breeds complacency. Investors would benefit from taking profits, rebalancing, and avoiding high valuation stocks during bull markets. Those strategies, however, tend to be ignored when markets appear strongest.

Noneconomic forces contributed to the 1987 collapse. A week before Black Monday, Congress passed legislation that removed a tax benefit for companies who borrowed money to finance mergers and acquisitions. Days later, oil-related conflicts in the Middle East involving the created additional concerns. Both are reminders that government policies and geopolitical events can quickly inflict pain upon investors.

Again: Smart people do stupid things when they panic. That leads to short-term market swings much larger than common sense would justify. One result of Black Monday was the implementation of "circuit breakers" that halt trading temporarily if the stock market begins to free fall. The fact this rule exists is an acknowledgment that humans (and therefore markets) are prone to behave irrationally.

No matter how unlikely it may seem at the time, U.S. equity markets historically have always recovered. Despite the incredible financial losses incurred on Black Monday, they still proved to be temporary. On the one-year anniversary of Black Monday, the Dow had risen 23 percent. Two years removed, it had increased 50 percent!

Perhaps the most important lesson from Black Monday is the value of a long-term perspective. Those who remain invested will ultimately be rewarded. Today (16th Oct. 2017) the Dow is approaching 23,000, more than 13 times its value after the closing bell rang on that historic day.

link: