Related Categories

Related Articles

Articles

21st August 2019:

The bond market signaled a recession - again(!).

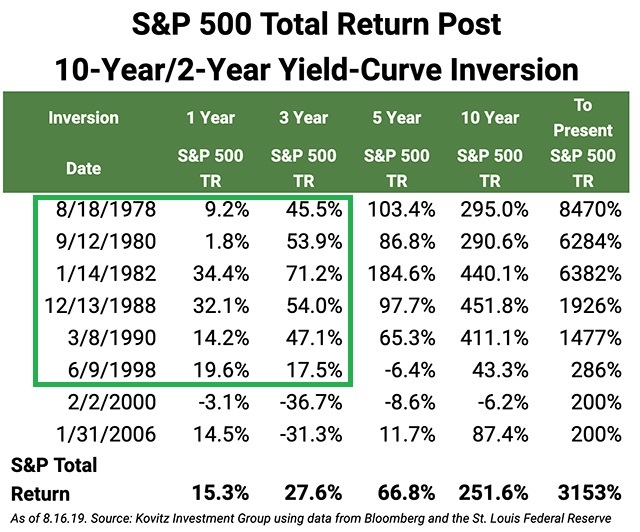

For the second time in a week, the closely watched 2-year Treasury note rate rose above its longer-term counterpart in the 10-year Treasury note, representing an inversion of the...

...bond-market yield curve. Yields inverted almost exactly a week before and investors have grown increasingly anxious about the gauge, which has preceded the past seven recessions.

However, that Wednesday's inversion isn't anymore alarming than it was a week before. The yield curve is a line plotting out yields across maturities. Typically, it slopes upward, with investors demanding more compensation to hold a note or bond for a longer period given the risk of inflation and other uncertainties. But, a legitimately inverted yield curve, for many needs to remain in force for a lengthier period than a day or days before it truly indicates a coming recession.

Reminder: From 1956, past recessions have started on average around 15 months after an inversion of the 2-year/10-year spread occurred, according to Bank of America Merrill Lynch.

That day (21st Aug. 2019) the Dow Jones Industrial Average DJIA, finished that Wednesday's trade up 240 points, or 0.9%, at 26,202, the S&P 500 index advanced 0.8% at 2,924, while the Nasdaq Composite Index COMP, closed 0.9% higher at 8,020.

AAII-Sentiment

22nd August 2019

Optimism about the short-term direction of the stock market among individual investors remains at an unusually low level despite rebounding for a second consecutive week. The latest AAII Sentiment Survey also shows slightly higher neutral sentiment and lower bearish sentiment.

Bullish sentiment, expectations that stock prices will rise over the next six months, rose 3.5 percentage points to 26.6%. Nonetheless, optimism is below its historical average of 38.0% for the 26th time this year.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, rose 1.7 percentage points to 33.6%. The increase keeps neutral sentiment back above its historical average of 31.5% for the 13th time in 14 weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, fell 5.1 percentage points to 39.7%. Pessimism is above its historical average of 30.5% for the 12th time in 15 weeks.

(!!!) >> As noted above, bullish sentiment continues to be at an unusually low level (more than one standard deviation below average). Historically, the S&P 500 index has experienced above-average and above-median returns during the six- and 12-month periods following unusually low levels of optimism. Bearish sentiment is back within its typical range, though barely so.

Many individual investors have been monitoring trade negotiations, particularly between the U.S. and China. Additionally, many AAII members expect a recession to start within the next 12 to 24 months. Also having an influence on sentiment are Washington politics, geopolitics, valuations, corporate earnings, monetary policy and interest rates.

link:

https://www.marketwatch.com/story/the-yield-curve-inverted