Related Categories

Related Articles

Articles

The phases of the economy provide a framework for sector allocation

Over the intermediate term, asset performance is often driven largely by cyclical factors tied to the state of the economy, such as corporate earnings, interest rates, and inflation. The business cycle, which encompasses...

source: www.fidelity.com

...the cyclical fluctuations in an economy over many months or a few years, can therefore be a critical determinant of equity market returns and the performance of equity sectors.

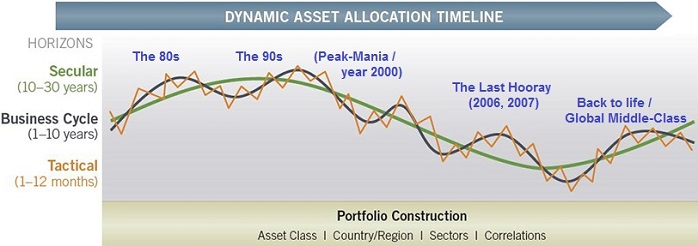

Asset price fluctuations are driven by a confluence of various short-, intermediate-, and long-term factors that may cause performance to deviate significantly from historical averages. For this reason, incorporating a framework that analyzes underlying factors and trends among the following three temporal segments can be an effective asset allocation approach: tactical (one to 12 months), business cycle (one to 10 years), and secular (10 to 30 years).

Understanding business cycle phases

Every business cycle is different in its own way, but certain patterns have tended to repeat themselves over time. Fluctuations in the business cycle are essentially distinct changes in the rate of growth in economic activity, particularly changes in three key cycles - the corporate profit cycle, the credit cycle, and the inventory cycle - as well as changes in the employment backdrop and monetary policy. While unforeseen macroeconomic events or shocks can sometimes disrupt a trend, changes in these key indicators historically have provided a relatively reliable guide to recognizing the different phases of an economic cycle.

Asset performance is driven by a confluence of:

various short-, intermediate-, and long-term factors

The performance of economically sensitive assets such as stocks tends to be the strongest during the early phase of the business cycle, when growth is rising at an accelerating rate, then moderates through the other phases until returns generally decline during the recession. In contrast, more defensive assets such as Treasury bonds typically experience the opposite pattern, enjoying their highest returns relative to stocks during a recession, and their worst performance during the early cycle.

Equity sector performance patterns

Historical analysis of the cycles since 1962 shows that the relative performance of equity market sectors has tended to rotate as the overall economy shifts from one stage of the business cycle to the next, with different sectors assuming performance leadership in different economic phases.

Due to structural shifts in the economy, technological innovation, varying regulatory backdrops, and other factors, no one sector has behaved uniformly for every business cycle. While it is important to note outperformance, it is also helpful to recognize sectors with consistent underperformance. Knowing which sectors of the market to avoid can be just as useful as knowing which tend to have the most robust outperformance.

Let's take a look at the Mid-cycle phase

As the economy moves beyond its initial stage of recovery and as growth rates moderate, the leadership of interestrate- sensitive sectors typically has tapered. At this point in the cycle, economically sensitive sectors still have performed well, but a shift has often taken place toward some industries that see a peak in demand for their products or services only after the expansion has become more firmly entrenched. Average annual stock market performance has tended to be fairly strong (roughly 15%), though not to the same degree as in the early-cycle phase.

In addition, the average mid-cycle phase of the business cycle tends to be significantly longer than any other stage (roughly three and a half years), and this phase is also when most stock market corrections have taken place. For this reason, sector leadership has rotated frequently, resulting in the smallest sector-performance differentiation of any business cycle phase. No sector has outperformed or underperformed the broader market more than three-quarters of the time, and the magnitude of the relative performance has been modest compared with the other three phases.

Information technology has been the best performer of all the sectors during this phase, having certain industries - such as software and hardware - that typically pick up momentum once companies gain more confidence in the stability of an economic recovery and are more willing to make capital expenditures. Sector leadership has rotated frequently in the mid-cycle phase, resulting in the smallest sectorperformance differentiation of any business cycle phase.

Sector leadership has rotated frequently in the mid-cycle phase, resulting in the smallest sector-performance differentiation of any business cycle phase.

The industrials sector has lacked consistent outperformance, but contains industries that are well suited for a mid-cycle expansion. For example, capital-goods producers tend to benefit from the pickup in demand in an environment of sustained and more predictable economic growth. From an underperformance perspective, the utilities and materials sectors have lagged by the greatest magnitude. Due to the lack of clear sector leadership, the mid-cycle phase is a market environment in which investors may want to consider keeping their sector bets to a minimum while employing other approaches to generate additional active opportunities.

Late-cycle phase

The late-cycle phase has had an average duration of roughly a year and a half, and overall stock market performance has averaged a little over 5% on an annualized basis. As the economic recovery matures, the energy and materials sectors, whose fate is closely tied to the prices of raw materials, previously have done well as inflationary pressures build and the late-cycle economic expansion helps maintain solid demand.

Elsewhere, as investors begin to glimpse signs of an economic slowdown, defensive-oriented sectors - those in which revenues are tied more to basic needs and are less economically sensitive, particularly health care, but also consumer staples and utilities - generally have performed well. Looking across all three analytical measures, the energy sector has seen the most convincing patterns of outperformance in the late cycle, with high average and median relative performance along with a high cycle hit rate.

Information technology and consumer discretionary stocks have lagged most often, tending to suffer the most during this phase, as inflationary pressures crimp profit margins and investors move away from the most economically sensitive areas.

The merits of the business cycle approach

The business cycle approach offers considerable potential for taking advantage of relative sector-performance opportunities. As the probability of a shift in phase increases - for instance, from mid-cycle to late-cycle - such a strategy allows investors to adjust their exposure to sectors that have prominent performance patterns in the next phase of the cycle.

Investment implications

Every business cycle is different, and so are the relative performance patterns among equity sectors. However, using a disciplined business cycle approach, it is possible to identify key phases in the economy, and to use those signals in an effort to achieve active returns from sector allocation.