Related Categories

Related Articles

Articles

Austrian Economics

(Definition)

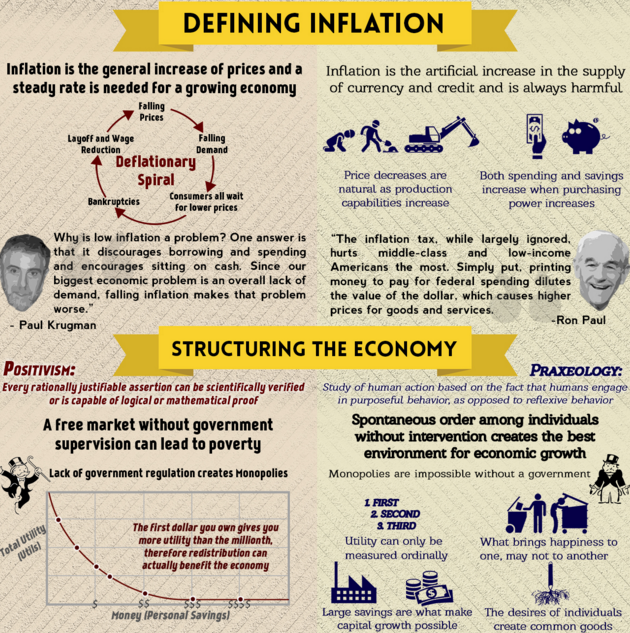

It is the School of economic thought originating in Austria in the late nineteenth century which focuses on the concept of opportunity cost. Following some confronting views of Keynesian Economics VERSUS Austrian Economics:

source: http://theaustrianinsider.com

source: http://theaustrianinsider.com

In economic theory, the term Austrian School stands for liberalism and laissez-faire-economics (where economic performance is optimised when there is limited government interference).

The Austrian School of economics has its original roots in the work of Carl Menger from the University of Vienna . References to the topic were first published in 1871. Well-known followers of Menger included Eugen von Böhm-Bawerk (1851 – 1914), Ludwig von Mises (1881 – 1973) and, perhaps most important, Friedrich A. Hayek (1899 – 1929).

Hayek, for example, strongly rejected any intervention by the state in the economy. For him, markets work perfectly in the sense that the market price balances supply and demand. A perfect market is one characterised by easy access to information, no barriers to entry and with prices controlled by all participants.

Due to the global financial crisis of 2007 and 2008, the popularity of the Austrian School of economics has experienced a boost in recent times because it had predicted, a long time ago, that too much debt – due to too low interest rates – would trigger investment bubbles followed by a crisis after these bubbles burst. One example may be Ireland’s property bubble, which was fuelled by reckless lending by banks to property developers.

Example:

In contrast to Keynesianism, the Austrian School of thought holds that the business cycle is driven by the supply side of the economy, not demand. If interest rates are too low, we will have over-investment. This may lead to over-production, which may trigger a crisis. During the crisis, supply declines until it is once again equal to overall demand. Then a new cycle starts.

For the Austrian school, the main challenge is not inflation, but over-investment in the face of too much money, or too-low interest rates that can lead to a crisis. Too much money means that the growth of money supply is much higher than the growth of goods and services in an economy. This leads to inflation, which is an increase in the average prices of all goods because there is more money available.

This means that the right level of the interest rate, called the ‘natural rate of interest’, is crucial to prevent a crisis. This type of interest rate attracts enough investment to ensure full employment and no inflation.

>>If the actual rate is equal to the natural rate, there is no inflation<<

source: http://lexicon.ft.com