Related Categories

Related Articles

Articles

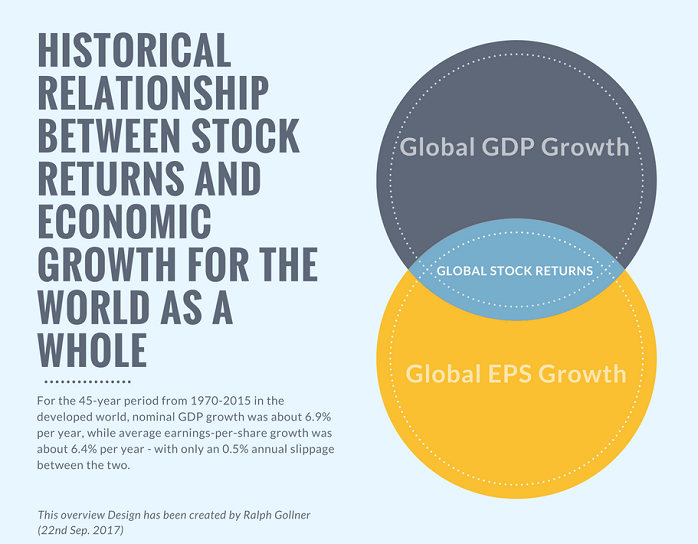

GDP Growth & Stock Market Returns

(1970 - 2015)

There is always (!) the relationship between macroeconomics and (financial) markets. There should be some skepticism that in a low global growth world we can maintain persistently high long-term market returns. There may actually be a simple...

...rough relationship between global economic growth and and market returns. The thing that drives both corporate profit growth (EPS-growth = Earnings-per-share growth) and economic growth (GDP-growth = Gross Domestic Product-growth) is the growth in final end-demand. In the absence of global economic growth the only way final end-demand can increase is through increasing credit issuance which at some point backfires like it did in the years 2008/2009. The other wild card in (higher) market returns is changes in Price-Earnings ratios (PE ratios).

>> Higher PE ratios push market returns higher with no increased corporate profit growth, but, again, at some point this backfires as it did in the tech bubble 2000 - 2003 ("Overvalued markets"). Having these principles in ones mind, let's take a look at some historical data:

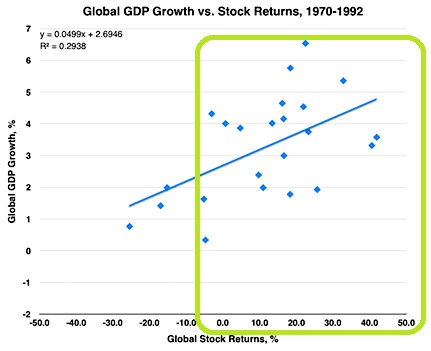

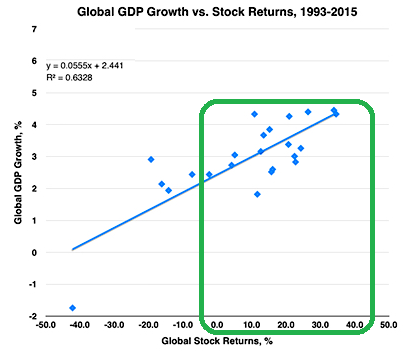

Using 46 years of global data on GDP growth rates and stock returns, we can divide this data into the pre-buyback era (23 years, 1970-1992) and the more recent buyback era (23 years, 1993-2015). Buyback era is the period, in which public companies started to buy back their own stocks for specific reasons (therefore reducing the number of shares in the market, potential boost to their stock-prices).

In the following charts below, we regress global GDP growth rates against global stock returns for the pre-buyback era (1970-1992) and the recent buyback era (1993-2015).

Prior to 1993, world GDP growth rates were highly variable, and have become generally more consistent in recent decades in the 2% - 5% range. At the same time, global stock returns appear to be more highly correlated with GDP growth (R^2 = 0.63), not less - in the most recent decades:

A remark on how to interpret the more recent results:

There is some evidence that forecasts of global growth have become much more accurate in recent decades - which may partly explain why the correlations with world stock returns have been increasing. Smaller GDP growth surprises therefore means: higher correlation with returns.