Related Categories

Related Articles

Articles

Quantity Theory of Money

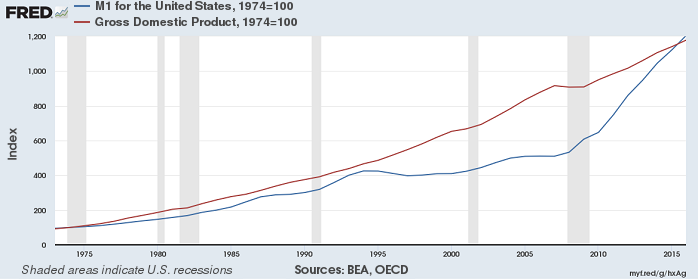

It is difficult to measure the money supply, but most economists use the Federal Reserve's aggregates known as M1 and M2. Gross domestic product, or GDP, is another government statistic that is tricky to measure perfectly, but nominal GDP...

...tends to rise with the money supply.

How the Money Supply Affects GDP

According to standard macroeconomic theory, an increase in the supply of money should lower the interest rates in the economy, leading to more consumption and lending/borrowing. In the short run, this should, but does not always, correlate to an increase in total output and spending and, presumably, GDP.

The long-run effects of an increase in the money supply are much more difficult to predict. There is a strong historical tendency for asset prices, such as housing, stocks, etc., to artificially rise after too much liquidity enters the economy. This misallocation of capital can also lead to waste and speculative investments, often resulting in burst bubbles and recession. On the other hand, it is possible money is not misallocated, and the only long-term effect is higher prices than consumers normally would have faced.

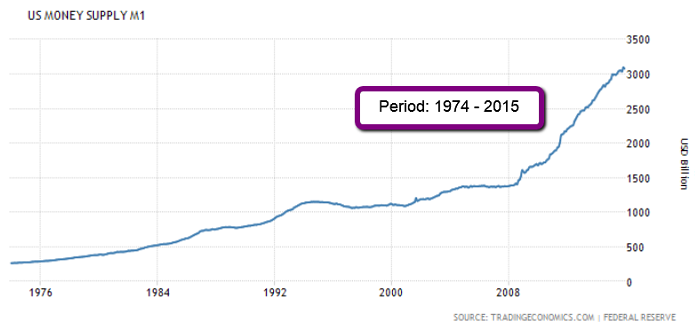

In 2015 the US-GDP (Gross Domestic Product in the United States) was worth ca. 18,000 billion US dollars. Reminder: The GDP value of the United States represents ca. 30 % of the world economy.

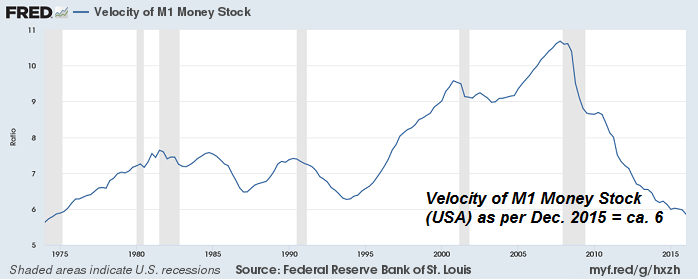

The classical quantity theory of money theory states that: money supply times velocity equals the price level times total real output. The quantity theory of money is M x V = P x Q, where M = money supply, V = velocity of money, P = average price level, and Q = total real output. Let's recap:

Money Supply x Velocity = Average Price Level x Real Output (GDP), or

Money Supply x Velocity = Nominal GDP.

Velocity represents the number of times (per year) money (one unit of currency) is used to purchase goods and services. Corresponds to classical "transactions" theory of money demand: money is used to buy goods and services. An increase in money supply (M) will lead to an increase in the desired level of transactions (P x Q).

Classical theory implication >> increase in money supply leads to inflation: with both velocity (V) and real output (Q) constant, an increase in M leads only to an increase in P.

Conclusion:

The available M1 money supply is USD 3,000 and nominal GDP is ca. 18,000. Applying the quantity theory of money we can conclude: the velocity of M1 money is ca. 6 (as indicated in the table below!). As you can see, the Velocity is falling year over year since the great Depression 2009!

Some criticism against the Quantity theory of money / Possible

undue Emphasis on Quantity of Money:

Quantity theorists (may) wrongly stress the role of the quantity of money as the main determinant of price level. Keynes, however, points out that the change in economicactivity or the price level is caused not a change in the quantity of money alone but also by other fundamental factors like income, expenditure, saving and investment. Thus, price level is not the function of money supply alone in turn, it is influenced by a large number of monetary and nonmonetary factors.

One further possible outcome: If velocity is constant we get, approximately, the growth rate of money equals the growth rate of prices (inflation) plus the growth rate of output >>

m = p + y

Therefore >> If money growth does not influence output, then higher money growth leads to higher inflation. Period. This prediction is overly strong, but the simplicity has some value of its own, including making it easy to remember. As Milton Friedman put it: "Inflation is always and everywhere a monetary phenomena."

But let's give a strange twist to Friedman's quote: "Inflation might be a monetary phenomenon, but the money is a reflection of bad fiscal policy, not monetary policy. We might say instead: "Inflation is always and everywhere a fiscal phenomenon."

To understand better why inflation is a fiscal phenomenon, note that a government with a budget deficit can finance it either by printing money (that leads to seignorage or the inflation tax) or by issuing public debt.

links:

www.investopedia.com/ask/answers

https://tradingeconomics.com/united-states/gdp

www.lidderdale.com/econ/311/ch8Prob