Related Categories

Related Articles

Articles

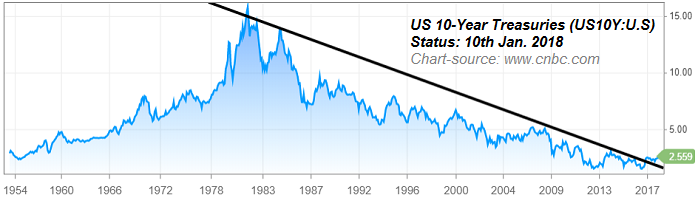

US 10year-Treasury yield

The longest-running and most important market trend of them all >> The 10-year Treasury yield, arguably the most important number in world finance, which sets the notional "risk-free rate" in global transactions, has trended down steadily...

...ever since Paul Volcker's Fed stamped out inflationary psychology in the early 1980s. Bond yields have ticked up since the recent tax cut passed and are very close to breaking above that steady downward trend >> in a sustainable manner.

Scepticism about chartism and technical analysis is always justified. But sometimes a trend is so obvious and strong that it is foolish to deny it ! IF the downward trend in 10-year yields were at last -in a sustained manner- broken, it would be profoundly important.

Most investors (and traders) today have no idea what it is like for yields to trade upwards. It would open the risk of a financial accident. Meaning, that sharply (!) higher yields COULD crimp the economy, put over-extended corporate credit under pressure and render high stock valuations impossible to justify.

Conclusio: This drastic change in interest-yields could change everything for asset markets.