Related Categories

Related Articles

Articles

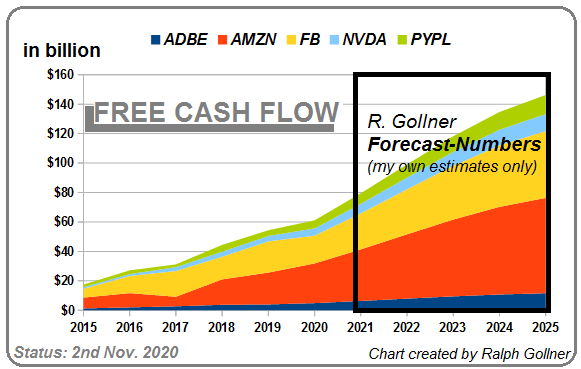

FREE CASH FLOW

(years 2015 bis 2025e)

A long-standing question about valuation-metrics...

Which is better: earnings or free cash flow?

Well, why not track both numbers to make the smartest moves? Earnings information provides a nice summary of a company's day-to-day operations and...

...long-term sustainability, and the calculation uses a more gradual reduction of capital expenditures using depreciation of assets. Free cash flow, on the other hand, represents the hard money brought in from operations minus the purchase of assets and dividends paid out.

Free cash flow can alert you to the potential dangers that may result from a lack of liquidity. Looking at the positive or negative movement of a company's reported free cash flow will help you figure out if it has the necessary funds to finance capital expenditures and keep paying dividends.

If you invest in a blue chip stock with consistently falling free cash flow, be on the alert that dividends will decline or disappear. But if the company is new and enjoying high growth, you may want to wait out a period of negative free cash flow to see if the company can turn things around.

Disclaimer/Disclosure: Ralph Gollner hereby discloses that he directly owns securities of Adobe, Amazon, Facebook, Nvidia and PayPal as per 3rd Nov. 2020.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Adobe, Amazon, Facebook, Nvidia und PayPal befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 3. November 2020.