Related Categories

Related Articles

Articles

Risky Sector, but the future "lies in their hands"

BIOTECH

Status @ the start of August (but now we are @ the last day of Aug. and some M&A-Activity has "taken over" - yes, some play on words...): Under-owned, undervalued? While bio-pharma's long-term growth drivers haven't changed, its...

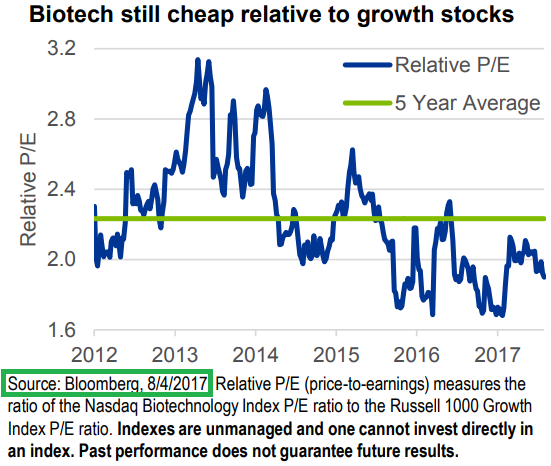

...investor base may have. The momentum breakdown in 2015 and lingering political headwinds led to industry wide outflows and cheapened valuations. Relative valuations - measured here as the ratio of the Nasdaq Biotechnology Index P/E to the Russell 1000 Growth Index P/E ratio - have cheapened over the past few years amid industry wide outflows and now sit below the 5 year average. However, valuations have stabilized as industry wide bio-pharma focused inflows have begun to recover. Long-term growth investors may want to consider biopharma given current valuations, lack of crowding, and potential long-term growth prospects.

But one should also remember, that the Russel 1000 Growth is not carrying an awful cheap valuation. Therefore some caution should be made - while considering that relative observation re. valuation.

I looked at the Price-Sales metrics of the Top 5 (big Biotech Names) in the Biotech-sphere, and often the P/S is below 6, or max. 10...so one can draw ones conclusion.