Related Categories

Related Articles

Articles

Value - "Comeback" (?)

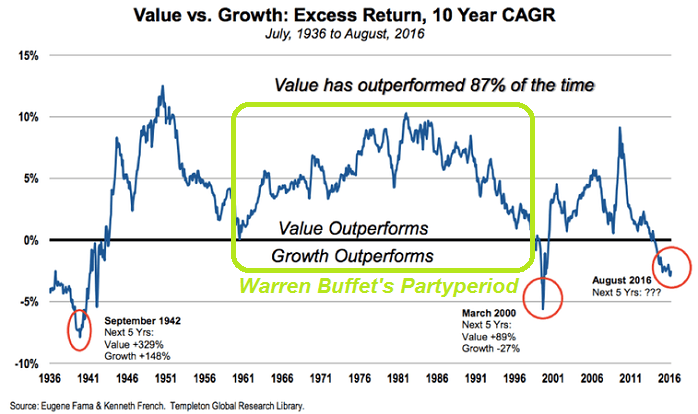

For anyone with more than a decade in the markets, the "value premium" is almost a sacred rule. The idea that stocks with lower valuation premiums would beat their more expensive "growth" peers is almost a given. Nobel laureates Eugene Fama and Kenneth French...

...first identified the value premium in 1992, comparing returns on high book-to-market value stocks against low book-to-market stocks. It's one of the three factors in their asset pricing model built to explain excess returns in a portfolio.

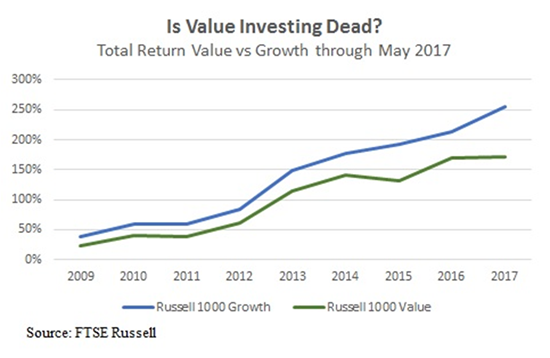

Since the financial crisis, the outperformance of value stocks has been called into question, with growth stocks easily besting their value peers. The shift has turned the traditional investing theme on its head (so far)...

But remember: Value stocks outperformed growth during the worst years of the last two market crashes, by 35% in the two years through 2001 and by 3% through 2008...

Theory and practical implications:

Finding value stocks for the potential shift back to outperformance means looking for companies that not only have lower price-to-earnings but also those with solid balance sheets. Companies with relatively lower debt burdens have the financial flexibility to weather the storm while their over-leveraged peers crumble.

Risks To Consider: Even if the value premium returns, some shares with low price-to-earnings ratios will underperform on company-specific factors. Furthermore: Who (really) knows, when(ever) Value-stocks will make their comeback again? For the moment (status: May 2017) also the "Factor" Momentum is a nice/big tailwind for the strongly performing growth stocks (Keyword: Nasdaq-100 companies):

Wrap-Up

A look at the very long term performance (see in the first chart above) regarding value versus growth investing shows: Value investing as a strategy has out-performed growth investing 87% of the time over the past 80 years as shown by the most recent Templeton analysis using ca. 80 years of data! So far - longterm-thinking and -investing has paid off quite often.

links:

www.nasdaq.com/article/