Related Categories

Related Articles

Articles

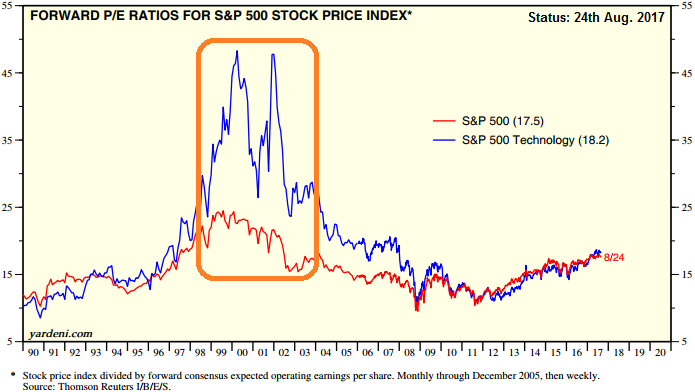

y2k Tech-Bubble Peak versus US-Stock Market

A short reminder about what really happened in the late 90s (last years of the last century) in the US-Stock Market, but also in global Tech-Stocks (extreme example: "Neuer Markt" in Germany). Please look at the disparity between the P/E-Ratios:

(Definition: P/E-Ratio stands for Price-Earnings Ratio) As one can see from the statistics, you really need Earnings-Growth in the medium- to longterm in order to have a reasonable tailwind to lift stock-valuations or the P/E-ratios. In the late 90s and in the quarters after the last century hit the Millenium not many companies in the tech-space with lofty Price-Sales Valuations even reached breakeven, therefore their business models produced losses rather then earnings.

The good thing is, nowadays the broad US-Stock Market is experiencing Earnings Growth again. The latest records regarding S&P 500-Earnings Growth show following figure yoy (year-over-year Growth): + 10.3%

This second quarter marked the second highest (year-over-year) earnings growth for the index since Q4-2011 (+ 11.6%). It also marked the first time the index has seen two consecutive quarters of (year-over-year) double-digit earnings growth since Q3-2011 (16.7%) and Q4-2011 (11.6%).

link/data:

FactSet https://insight.factset.com/hubfs/Resources (.pdf)