Related Categories

Related Articles

Articles

Emerging Markets

(Valuation)

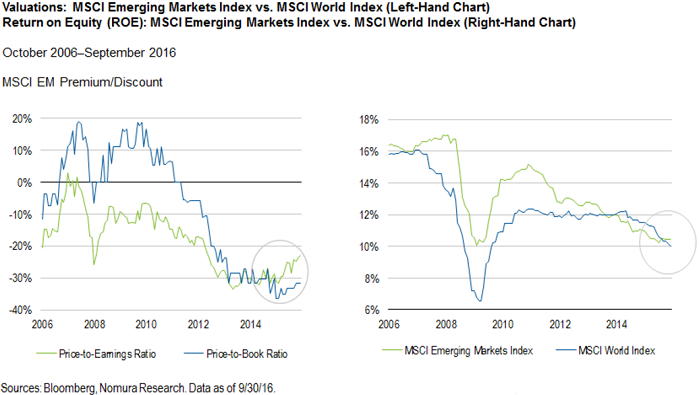

In terms of valuations, the MSCI Emerging Markets Index has traded at a significant discount to the MSCI World Index, for example, on a price-to-earnings-multiple basis. ("But") earnings growth trends have improved markedly during 2016!

Emerging-market countries are still far behind their developed-market counterparts when it comes to overall GDP-per-capita, and so one may continue to expect strong growth prospects over the long term.

One important factor, which can favor and should sustain the "catch-up development" over the long term is that the debt-to-GDP ratios of emerging-market countries are generally below those of developed markets. Furthermore, interest-rate differentials between the two groups are wide, giving emerging-market central banks greater flexibility to maneuver, if required, in the future.

As always, and especially needed for EM-investors, it will be important for investors to take a long view and not be swayed by short-term gyrations that we might continue to see in financial markets.

source: Linked-In Article "emerging-market-equity-2017-outlook-mark-mobius" (20th Dec. 2016)