Related Categories

Related Articles

Articles

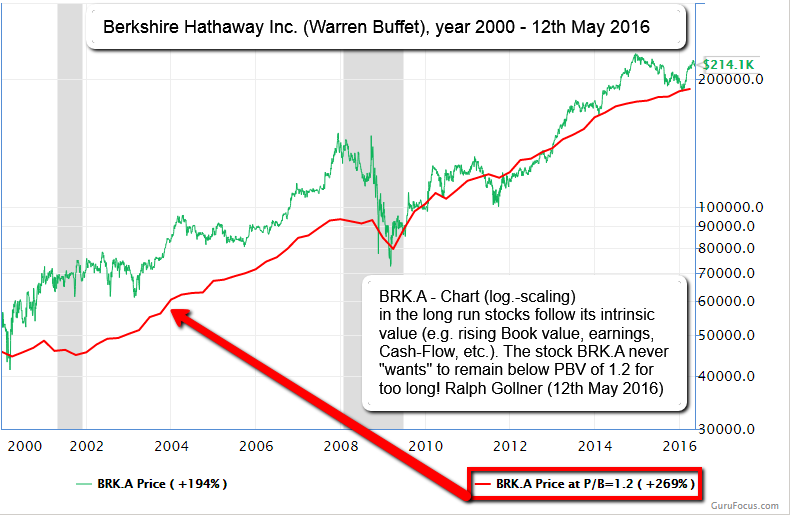

Berkshire Hathaway (P/B-Valuation)

time period: 2000 - May 2016

In his book "One Up on Wall Street", Peter Lynch, maybe the best mutual fund manager ever, revealed a powerful charting tool that helped him to achieve a gain of 29.2% in his portfolios for 13 years.

In his chart, Peter Lynch drew the stock price and the earnings per share together and aligned the value of USD 1 in earnings per share to USD 15 in stock price. He wrote in pages 164-165 of the book:

"A quick way to tell if a stock is overpriced is to compare the price line to the earnings line. If you bought familiar growth companies when the stock price fell well below the earnings line, and sold them when the stock price rose dramatically above it, the chances are you'd do pretty well."

So -in theory- one could filter out stocks that are currently trading below their Peter Lynch Earnings Line. According to Peter Lynch, you will probably "do pretty well" with these stocks.

Magic Price-Book-Value level of 1.2 (Berkshire Hathaway)

With similar philosophy, I have created the chart above to find out, when Berkshire Hathaway-stocks traded below OR above the "magic" 1.2 book-value-line, which Warren Buffet often refers to.

One could create similar charts adding the (median) book value multiples, (median) sales multiples and (median) EBITDA multiples, etc...the options may be infinite...

Further remarks re. Warren Buffet-comment on "possible Buybacks of own stock below P/B-Valuation of 1.2":

30th April 2016:

Warren Buffett said in an interview that the odds were "extremely high" that his Berkshire Hathaway (BRK.A) would buy back "a lot" of its stock if the price fell below 1.2 times book value, a level it recently approached.

Speaking at Berkshire’s annual shareholder meeting in Omaha, Nebraska, Buffett also said he would consider raising the threshold "a little" if he found Berkshire with so much money that it "burns a hole in your pocket."

He said that could happen if Berkshire’s cash hoard rose to USD 100 billion or USD 120 billion, a level it has never reached and perhaps double what it is now, following January’s USD 32-billion purchase of industrial parts maker Precision Castparts.

"The stock is worth significantly more than 1.2" times book value, he (Warren Buffet) said.

Berkshire-Hathaway Earnings-realease on 6th May 2016:

Book value per share rose to USD 157,369 per Class A share as of 31st March 2016 from USD 155,501 three months earlier, while revenue rose 8 percent from a year earlier to USD 52.4 billion.

Berkshire made two big acquisitions in the quarter. It acquired airplane parts maker Precision Castparts for about USD 32.1 billion, and acquired battery maker Duracell from Procter & Gamble Co in exchange for that company's stock. The swap resulted in a USD 1.9 billion after-tax gain.

The company ended the quarter with USD 58.34 billion of cash, down from USD 71.73 billion at year end, largely because of Precision Castparts.

It also owns USD 106.4 billion of stocks such as International Business Machines Corp, which it plans to keep despite sitting on a USD 1.5 billion unrealized loss as of 31st March .

Berkshire owns 26.8 percent of Kraft Heinz Co, and with Brazilian private equity firm 3G Capital has a controlling stake in the food company.

Kraft Heinz on Wednesday posted a larger-than-expected quarterly profit, helped by cost cuts as some shoppers seek out fresher alternatives to its packaged, processed foods.

In Friday trading, Berkshire Class A shares closed up 0.5 percent at USD 216,999.99, and its Class B shares closed up 0.5 percent at USD 144.62, according to Reuters data.

links:

http://fortune.com/2016/04/30/warren-buffett-buy-back-stock