Related Categories

Related Articles

Articles

Back-of-the-envelope calculation (?)

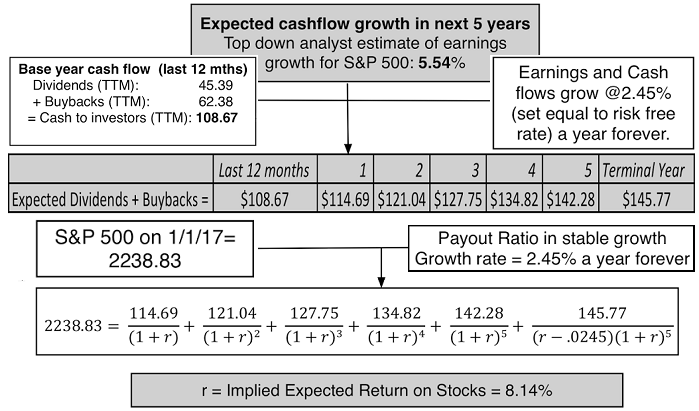

Aswath Damodaran is a Professor at the Stern School of Business at New York University and Expert when it comes to Valuation(-techniques). He estimates expected cash flows from dividends and buybacks from holding the S&P 500 for the next five years,...

...using the trailing 12-month cash flow as his starting point and an expected growth rate in earnings as proxy for cash flow growth. He then used these estimates, in conjunction with the index level on 1st January 2017, to compute an internal rate of return (a discount rate that will make the present value of the expected cash flows on the index equal to the traded level of the index).

"1st guess": Given the level of the index (2,238.83 on 1st January 2017) and expected cash flows, he estimates an expected return on 8.14% for stocks and netting out the T.Bond rate of 2.45% on 1st January 1, 2017 yields an implied Equity Risk Premium (ERP) for the index of 5.69%. That number is down from the 6.12% that he estimated at the start of 2016 but is still well above the historical average (from 1960-2016) for this implied ERP of about 4.11%.

There is one troubling feature to the trailing 12 month cash flows on the S&P 500 that gives him pause. As was the case last year, the cash flows returned by S&P 500 companies represented more than 100% of earnings during the trailing 12 months, an unsustainable pace even in a mature market. He then recomputed the ERP on the assumption that the cash payout ratio will decrease over time to sustainable levels, i.e., levels that would allow for enough reinvestment given the growth rate. This next computation step I will show in the next days/next posting...