Related Categories

Related Articles

Articles

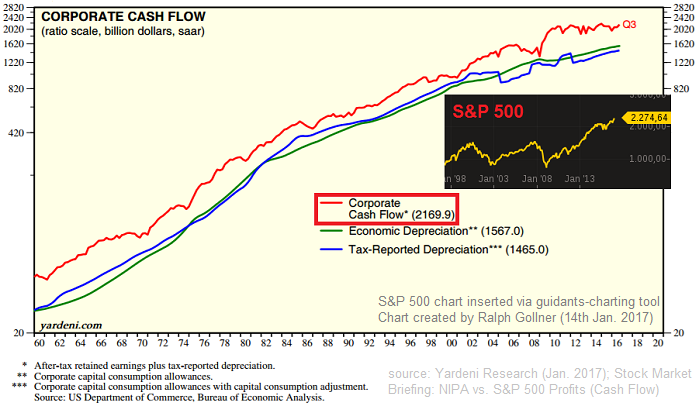

Cash Flow and S&P 500 - connection

(correlation?)

There are several ways to estimate an intrinsic stock valuation. Companies have an intrinsic value, and that intrinsic value is based on the amount of free cash flow they can provide during their effective lifetime.

Money later is worth less than money now, however, so future free cash flows have to be discounted at an appropriate rate.

But stock valuation is not that easy in practice, because we can only estimate future free cash flows. This valuation approach, therefore, is a blend of art and science. Given the inputs, the outputs are factual. If we knew exactly how much cash flow is to be generated, and we have a target rate of return, we can know exactly what to pay for a dividend stock or any company with positive free cash flows regardless of whether it pays a dividend or not. But the inputs themselves are only estimates, and require a degree of skill and experience to be accurate with. Hence, stock valuation is art and science.

An Example of Stock Valuation

If someone offered you a machine that was guaranteed to (legally) give you USD 10 per year, and the machine had zero maintenance costs, what would be a sensible amount of money to pay for this machine? It would depend on a few factors.

1) The USD 10 represents owner's profit, or free cash flows. This is money you get free and clear.

2) Due to the time value of money, USD 10 next year is not as valuable to you as USD 10 this year. Why? Because you could take USD 10 this year and probably invest it and turn it into USD 10.50 or USD 11 by next year.

This second point brings up the purpose of discounting. You have to discount the future money by an appropriate value in order to translate it into today’s value. How much you discount it by can vary. You could, for example, use a "risk-free" rate of return, such as the yield on a U.S. Government Treasury Bill. Or, you could use Weighted Average Cost of Capital (WACC). More simply, what you could also use is your targeted rate of return.

If you want to get, say, a 10% rate of return on your money, then you should use a discount rate of 10%. You may also alter it depending on your estimation of the level of risk involved. For a higher risk investment you may use a higher discount rate (perhaps 12% or so), while in very defensive and reliable business I may use a discount rate of a bit under 10% (maybe 9.5?).

If we have a sum of annual future cash flows, then the equation is this:

DPV = (FV1)/(1+r) + (FV2)/(1+r)^2 + … + (FVn)/(1+r)^n

This is on of the very well-known stock valuation equations.

Three Primary Stock Valuation Methods

Many valuation metrics are readily calculated, such as the price-to-earnings ratio, or price-to-sales, or price-to-book. But these are numbers that only hold value with respect to some other form of stock valuation.

The three primary stock valuation methods for evaluating a healthy dividend stock are:

1) Discounted Cash Flow Analysis

2) The Dividend Discount Model

3) Earnings Multiple Approach

1) Discounted Cash Flow Analysis

The first method, Discounted Cash Flow Analysis, is to treat the company as one big free cash flow machine. We analyze the company as though we would buy the whole thing and hold it indefinitely for all of its future free cash flows.

2) The Dividend Discount Model

The second method, the Dividend Discount Model, is to treat an individual share as one little free cash flow machine. The dividends are the free cash flow, since that's the cash that we as investors get. In the company-wide example, a company could spend free cash flows on dividends, share repurchases, acquisitions, or just let it build up on the balance sheet, and the point is, we have little control over what management decides to do with it. The dividend, however, takes all of this into account, because the current dividend as well as the estimated growth of that dividend takes into account the free cash flows of the company, and how management is using those free cash flows.

3) Earnings Multiple Approach

The third method, sometimes called an Earnings Multiple Approach, can be used whether or not the company pays a dividend. The investor estimates future earnings over a period of time, such as ten years, and then places a hypothetical earnings multiple on the final estimated EPS value. Then, cumulative dividends are taken into account, and the difference between the current stock price, and the total hypothetical value at the end of the time period, are compared in order to calculate the expected rate of return.